Garbage shares mean which have totally no value in them, this term “garbage” I use for that share which are manipulated or which are fundamentally bad. But in the market, there are many people recommending this kind of shares, and I know people will get trap in them because first, some groups of investors will try to increase their price and many then retail investors will start tracking that share and in the last they will enter them and that particular group will exit at higher rates and trap many innocent investors, so from this article you can identify garbage shares by looking into charts, Basically you have to track price and volume part that’s all.

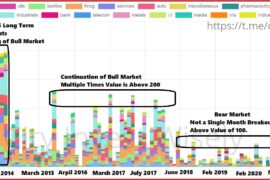

There are 3 types of garbage companies in the market.

- Price/volume manipulation: People try to handle price and volume 80% of total garbage companies comes under this.

- Corporate governance garbage: Companies which have corporate governance Issues and have very little fundamentals, generally these are small caps, like sunil hitech, kwality, sumeet Industries, Ujaas energy.

- Fundamental garbage share: These are generally good names but bad fundamentals, and all have bearish setup in long-term technical charts.

Corporate Governance Issues: Promoter selling a stake in the open market without informing the exchange, Promoter’s pledge share sold by brokers, Promoter pushing the price or Promoter playing with the share price, there are many more Issues but these are Important one.

If you are new in the market then there is a high chance that you will get trap in all this manipulative game, here how all this game starts,

- Some big groups of investors will push the price up by doing circular trading.

- Then they start publishing good news about that particular company in many social media and some good names are also involved in this they also promote these garbage companies and get some commission out of it. (Here I am talking about price/volume manipulative stocks).

- Retail Investors will get to know these stocks from social media and generally they track top gainers of money control and from there also they get the names, and they start reading comments in money-control forum from there also small investors get the confidence of buying that garbage share there you will get these kinds of comments “Buy at 10 this next week target 20-30-50” “Buy in huge qty” “Next multibagger” ( Moneycontrol forum = garbage forum)

- Manipulator main aim is to get make a profit by pushing the price higher and after one-time frame, they will start selling shares in small qty. and on the other hand, the buyer is always small retail investors.

Circular trading: That means pushing the price of a share by a group of investors who have some good qty. of shares. In this sometimes promoter of companies also involve.

Rectangle: High Volume patch, Circle: No volume patch

In any kind of free market, this kind of thing will never be there, but here this happens because some group of Investors holding up the volume. Check the red rectangle, Huge volume is there but near to exact same levels, and in the Free market that never happens. That means someone holding up the volume of share.

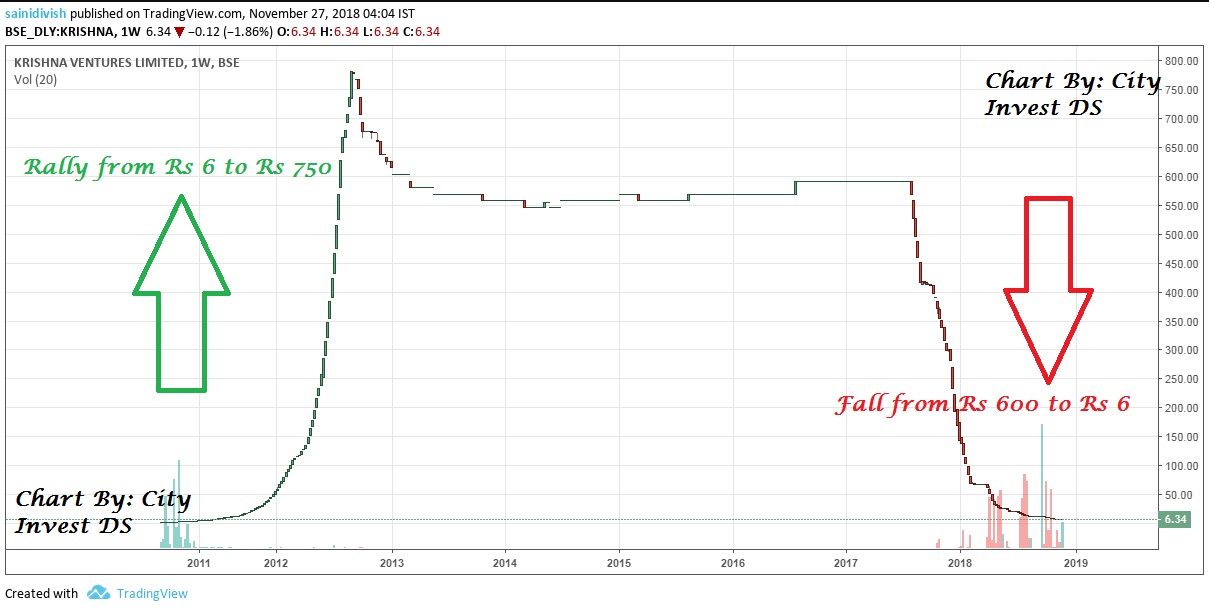

Shares hitting regular upper circuits without any news with high volume are the main contender of Garbage list. after booking profit Manipulator’s main aims is to erode the value of share by up to 70-90%. check some example below. I used to trade in these kinds of share in 2012-13, I know how to deal with these kinds of shares, but entry and exit is very difficult in them because 98% of times price will be in circuits. In 2013 at one time I had a list of near about 150-180 share list which has the same pattern, In 2016 SEBI took some action and suspended 70% of companies but still, this game is ON in market.

I used to trade in these kinds of share in 2012-13, I know how to deal with these kinds of shares, but entry and exit is very difficult in them because 98% of times price will be in circuits. In 2013 at one time I had a list of near about 150-180 share list which has the same pattern, In 2016 SEBI took some action and suspended 70% of companies but still, this game is ON in market.

In the past, if a company had above 80% fall in the very short term is always be termed as garbage share, like taking the example of Gitanjali gems, In 2013 share price of this company fell from Rs 600 to Rs 60, this will give warning for the future that again it can erode value like this and same happen in 2018 price went down from Rs 60 to Rs 3.

Time to Time Will update about this kind of things and be aware of random shares check Garbage share list here.

Fundamental Garbage share: Many good names are there like RCOM, a new investor can trap in this just by name but on the actual basis it has no value.

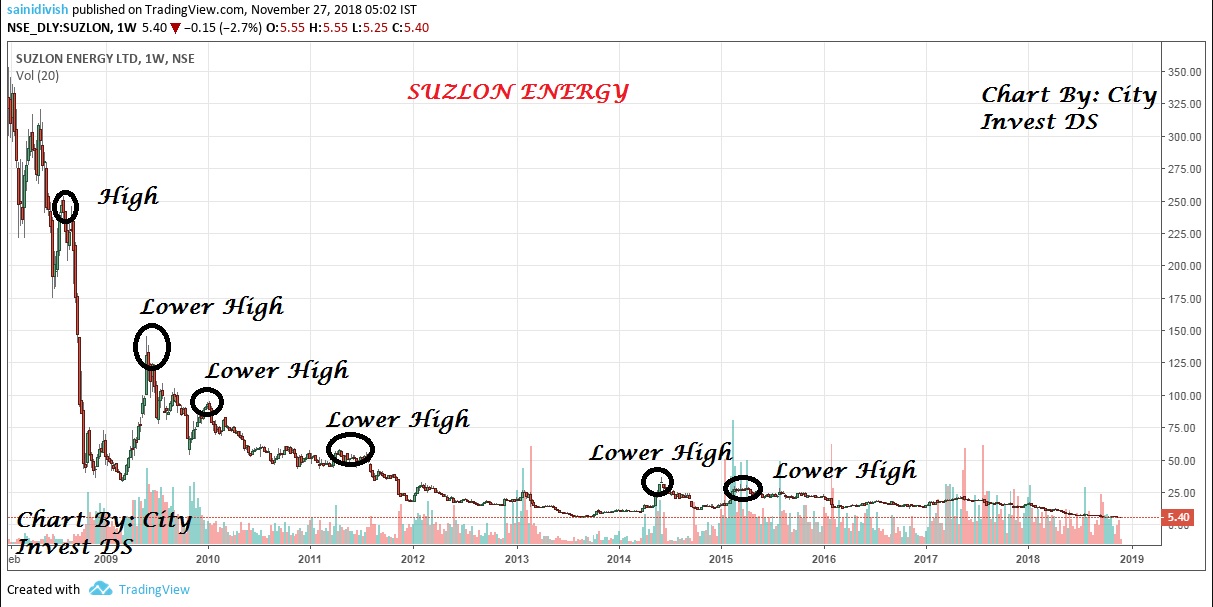

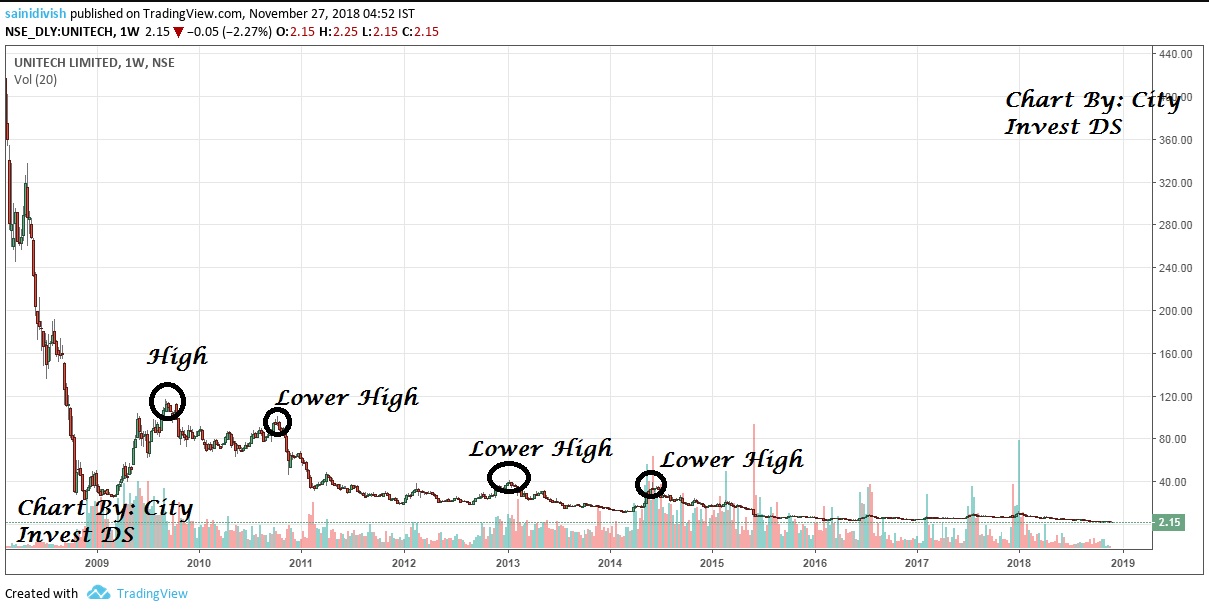

Many people have this question “How to check the value of a share just by looking into technical charts?” In Technical analysis one of the best way to check value is to track the Formation of these two patterns.

- HH-HL = Higher High – Higher Low

- LL-LH = Lower Low – Lower High

If on long-term charts minimum 4-6 years you are getting the formation of LL-LH then it means share is Garbage because this is one of the most powerful Bearish patterns. And you can check all Fundamental garbage share you will get this pattern for sure. Taking three examples Suzlon, Unitech, RCOM.

Here you can see these share not able to breaks it’s previous high and in this process they are making Lower High and Lower low all the time, that means there is no value in it. But retail Investors wants to Invest in them because of low value and result will be losing 60-80% value.

“Garbage share will remain Garbage, even if Rakesh Jhunjhunwala buy some stake”

Above Line is for those people who run behind JPASSOCIATE when RJ bought some stake, he is big Investor, have a different mindset, but retail Investor can’t understand this. Alerted many times to avoid JPASSO at all cost, now you can see the price is touching new low near Rs 6 and in a few months it will be near Rs 3. From Rs 30 to Rs 6 (Vanished 80% of capital).

While doing Investment first filter out garbage share, then focus on shares which have some values that will help you in building a good portfolio. Don’t run behind rallying share you will surely get a trap.

“In life, it’s always good to know …”What not to do”. Similarly good to know what not to buy in the market.

5 Comments

Divish,

I have been following you from quora days.

I highly respect you. Can you please let me know your views on the recent happening in Meghmani organic .

Really need s your opinion to make some decisions. I am invested in Meghmani ( 90 levels) , but now confused.

Thanks

First of all main thing was the issue of the subsidiary company, in that only promoter can buy a stake, there was nothing for other shareholders, that’s why it dropped from 85 to 60 in last 3 weeks, and overall it’s a small cap so volatility will be high there. If you plan for long-term then good to hold, but not to make any high position in it. Once this issue is solved then the company will rally.

Hi brother,

Can you suggest a few good books to start with.

Hi, Please go to our books menu which is under more option.

Pingback: What is Sucker Rally & How to play it ? - City Invest Wisely