Domestic Market View

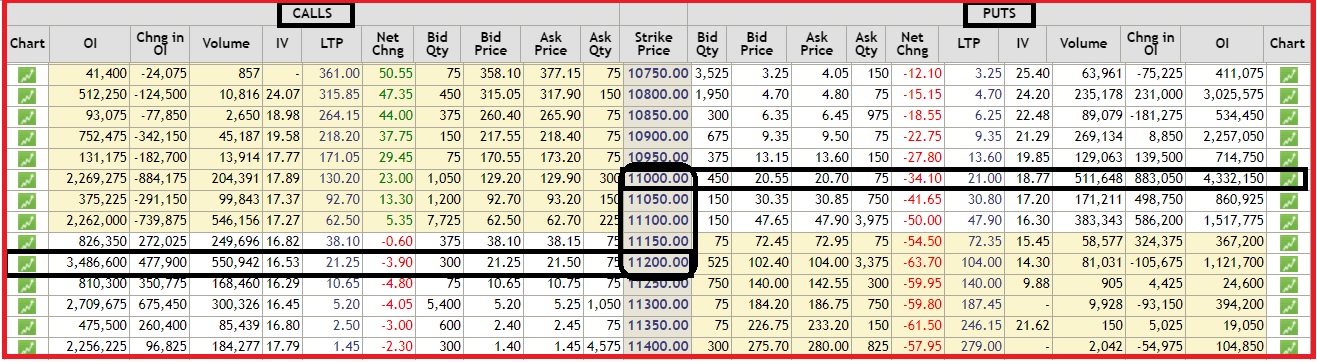

Yesterday was a full consolidation day as updated in the telegram channel, Now again Nifty will try to test upper range of 11150-11180. Very heavy cluster of Resistance is there at upper levels, Support wise 11050 is good support for market for Intra basis. It would be in range of 11180 and 11050. Tomorrow is expiry so again it will try to be in range only, premium eating will be there again, If there is any news/update about US-CHINA Trade wars then consolidation stance will change as per the news.

FII Sold share worth of 923 Crore and DII bought shares worth Rs 1162 Crore. Actually due to MSCI Emerging Market Rebalancing that’s why FII selling figure is there as one of the singapore Broker sold shares of HDFC Life and Heromoto corp. VIX at 16 level.

If we check FNO stats then some kind of consolidation will be there as per heavy open interest in 11200 call and 11000 put options.

Global Market View

Global Market was on mute yesterday, Still analyst waiting for US-CHINA Trade news, Interesting thing is China denied about the recent call to trump, they said they will not surrender, they will fight back and meanwhile USDCNY inching towards 7.20, If it breach and closes above 7.20 then Our INR will also be in pressure to touch 72.70-73 levels. Gold is near $1550, Brent oil near $59.5.

Stocks in News

- Sirpur Paper Mills to delist the share under section 31 of the Insolvency and Bankruptcy Code, 2016. Link

- Infosys : Discontinuance of Buyback of the shares. Link

- Wipro : Today Last date of Buyback of shares through Tender Offer.

- Tata Sponge to change it’s name to Tata steel Long products Limited. Link

- Today 10 company to Ex-Dividend. Krbl, Lux Industries, Dwarkesh etc. Link

- Natco Pharma : USDFA Warning.

- HDFC Bank : Nomura Brokerage Firm Revised Target from 2450 to 2600.

- IDBI Bank : S&P place bank on Negative credit watchlist.

- DB Realty : Promoter created pledge on 40 Lakh shares.

- Coal India : Today evening FDI meeting regarding commercial coal mining, So it’s a bad news for Coal India.

Change in Circuit Limits

| Sr. No. | Scrip Code | Scrip Name | Price Band % Revised to |

| 1 | 532886 | SEL Manufacturing Company Ltd | 10 |

| 2 | 539402 | Vaksons Automobiles Ltd | 10 |

| 3 | 511431 | Vakrangee Ltd | 5 |

| 4 | 532351 | Aksh Optifibre Ltd | 5 |

| 5 | 542669 | BMW Industries Ltd | 5 |

| 6 | 542685 | Digicontent Ltd | 5 |

HDFC Bank classic Morning Star Pattern in large cap share a Perfect Buying Opportunity for short term for return upto 4-5% in next 8-14 days. Buy 2257 stop loss 2140 Target 2315-2374.

Other ways to connect with us.

Website : www.cityinvestwisely.com

Facebook Page : https://www.facebook.com/cityinvestmentservices

Telegram Equity Channel : https://t.me/cityinvest

Telegram FNO Channel : https://t.me/cityfno

Telegram Equity Group for Discussion : https://t.me/Stocktalkdiv

Telegram FNO Group for Discussion : https://t.me/Fnotalkdiv

Telegram All world Assets Information : https://t.me/allworldassets

Quora : https://www.quora.com/profile/Divish-Saini-2

Twitter : https://twitter.com/gameoftrend