Yesterday Indian markets which witnessed 700 points fall in Sensex on Monday as the results of the exit polls do not indicate a possibility of BJP government coming into power. On the backdrop, we have a global headwind of falling global markets. As if these events were not enough for the Bears to celebrate, there’s another news for the Bears to continue their celebration – was the resignation of the RBI governor Mr. Urijit Patel’s post-market hours.

Though Mr. Urjit Patel has cited ‘personal reasons’ for his resignation, however, the market is clever enough to read in between the lines.

Though officially we do not know the actual reasons for Mr. Patel’s abrupt resignation. However, the line of events over the past couple of months triggered this resignation.

Line of Events:

- The government wanted to tap a share of the RBI reserves of ₹3.6 trillion ($48.73 billion) of capital reserves apart from the dividends to help fund the government fiscal deficit. The RBI dint gives in to such request of the government.

- The government wanted the RBI to provide more liquidity to the shadow banking sector, which is currently been hurt by the defaults of major financing company Infrastructure Leasing & Financial Services (IL&FS). As those defaults triggered a sell-off in bonds and stocks of non-banking financial companies (NBFCs).

- The government has been asking the RBI for a dedicated liquidity window for NBFCs to ease out the liquidity issues of the NBFCs.

- The government has also been urging the RBI to relax its lending restrictions on 11 state-run banks, which are under Prompt Corrective Action (PCA), as these banks have a low capital base and major bad debt problems.

- RBI did not budge to any of the unreasonable requests of the government, as was independently taking its stance. However, things didn’t go well when RBI decided to go public with its differences with the Government.

- On Oct 26, 2018; Dr. Viral Acharya, Dpty. Governor delivered a speech on the importance & the need to ensure the independence of the Central Bank. This speech was with the backing of Mr. Urijit Patel, as suggested in the footnotes of Dr. Acharya’s speech.

- Indeed this speech dint goes well with the Government, as the government sought consultations under Section 7 (rare provision) of the RBI Act. This act, allows the government to give directions to the central banks considered necessary in public interest in consultations with the Governor.

- In fact, there were media speculations since the October 31st, 2018 that Mr. Urjit Patel may resign due to differences with the Government. However, the issue then appeared to be resolved after the 9 hours long RBI board meeting on November 19, 2018.

The next RBI board meeting was scheduled for December 14, 2018, and Mr. Patel has resigned just 4 days before that.

The upcoming meeting scheduled on Dec 14, 2018, is considered crucial as the issues that would be discussed are amongst governance issue and concerns on liquidity and credit flow to productive sectors, especially Micro, Small & Medium Enterprises (MSME).

RBI would be headless for now, until a new governor is appointed. The next Governor’s appointment will be crucial in restoring the credibility of the Government and the RBI.

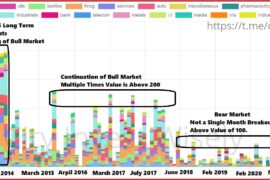

Impact: As it is the investors were already grappling with the global slowdown, upcoming political uncertainty, this resignation has only added to investors worry. Nifty may test 4 digit mark in near term.

Yesterday (December 11, 2018), Rupee depreciated by 1.5% and the 10-year yield had moved up by 12bps during the course of the day. Bonds Market and Rupee will get severe hit from this news, SGX NIFTY has already shed 3.5%/376 points ending the yesterday session at 10359, indicating a red open for the market today. On the positive side, the market may begin to factor in easier monetary policy/liquidity developments.

Nifty likely to open Gap down of 100 points after that voting results will be there, Rupee likely to open near 72.10 mark.

Chanakya’s quote “Straight Trees are cut first” summaries the ‘personal reasons’ for Governor’s resignation.

1 Comment

Pingback: Market conditions: When to buy shares ? - City Invest Wisely